idaho inheritance tax rate

Theres also no estate tax levied on a state basis in Idaho though you will be required to pay federal taxes on the estate in some instances which will be. If the total value of the estate falls below the exemption line then there is no estate tax applied.

2022 Capital Gains Tax Rates By State Smartasset

The District of Columbia moved in the.

. For more details on Idaho estate tax requirements for deaths before Jan. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

You will also likely have to file some taxes on behalf of the deceased. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at. Idaho has no gift tax and it is the most efficient.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Idaho has no state inheritance or estate tax. Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. However like all other states it has its own inheritance laws including the ones that cover. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

The inheritance tax is a tax on the beneficiarys gift. Idaho also does not have an inheritance tax. Idaho Inheritance and Gift Tax.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. Inheritance tax rates differ by the state. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

That is why it is vital to carefully assess your current estate and start estate planning if you want to preserve as much as possible and secure your heirs future. Idaho personal income tax rates. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

As of 2021 the six states that charge an inheritance tax. There is no federal inheritance tax but there is a federal estate tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

In other words the estate itself can be taxed for the amount that is above the exemption cut-off. No estate tax or inheritance tax Illinois. 65 on taxable income of 15878 or more for married joint.

As of 2004 the state of Idaho expired its estate and inheritance taxes. The top estate tax rate is 16 percent exemption threshold. The beneficiary of the property is responsible for paying the tax him or herselfâ.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. The gift tax exemption mirrors the estate tax exemption. Idaho state tax rates Idaho state income tax rate.

1 on taxable income up to 3176 for married joint filers and up to 1588 for individual filers High. Idaho state sales tax rate. Idaho Income Tax Range.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The US does not impose an inheritance tax but it does impose a gift tax. So it really depends on where the beneficiary lives and where the estate assets are.

How to avoid paying estate taxes in Idaho. These states have an inheritance tax. More good news for you Idaho does not impose an inheritance tax.

Idaho does not levy an inheritance tax or an estate tax. Idaho state income tax rates range from 0 to 65. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance.

You must complete Form CG to compute your Idaho capital gains deduction. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors.

The Federal Estate tax can reach up to 40 and comes into action even if the property exceeds the exemption bar by only 1. No estate tax or inheritance tax. Estates and Taxes.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for. As mentioned previously the probate process in Idaho typically takes anywhere from eight months to three years to finalize. And if your estate is large enough it may be subject to the federal estate tax.

Idahos capital gains deduction. As such the amount you receive can be spent or saved in any way you see fit. Inheritances that fall below these exemption amounts arent subject to the tax.

But certain inheritance laws in other states could be applicable. Keep in mind that if you inherit property from another state that state may have an estate tax that applies. For any inherited assets you should know that theres no income tax required either as these assets dont fall under ordinary income.

In states that do charge inheritance taxes like Iowa and Maryland those that inherit money or assets as a result of the death of a loved one will have to.

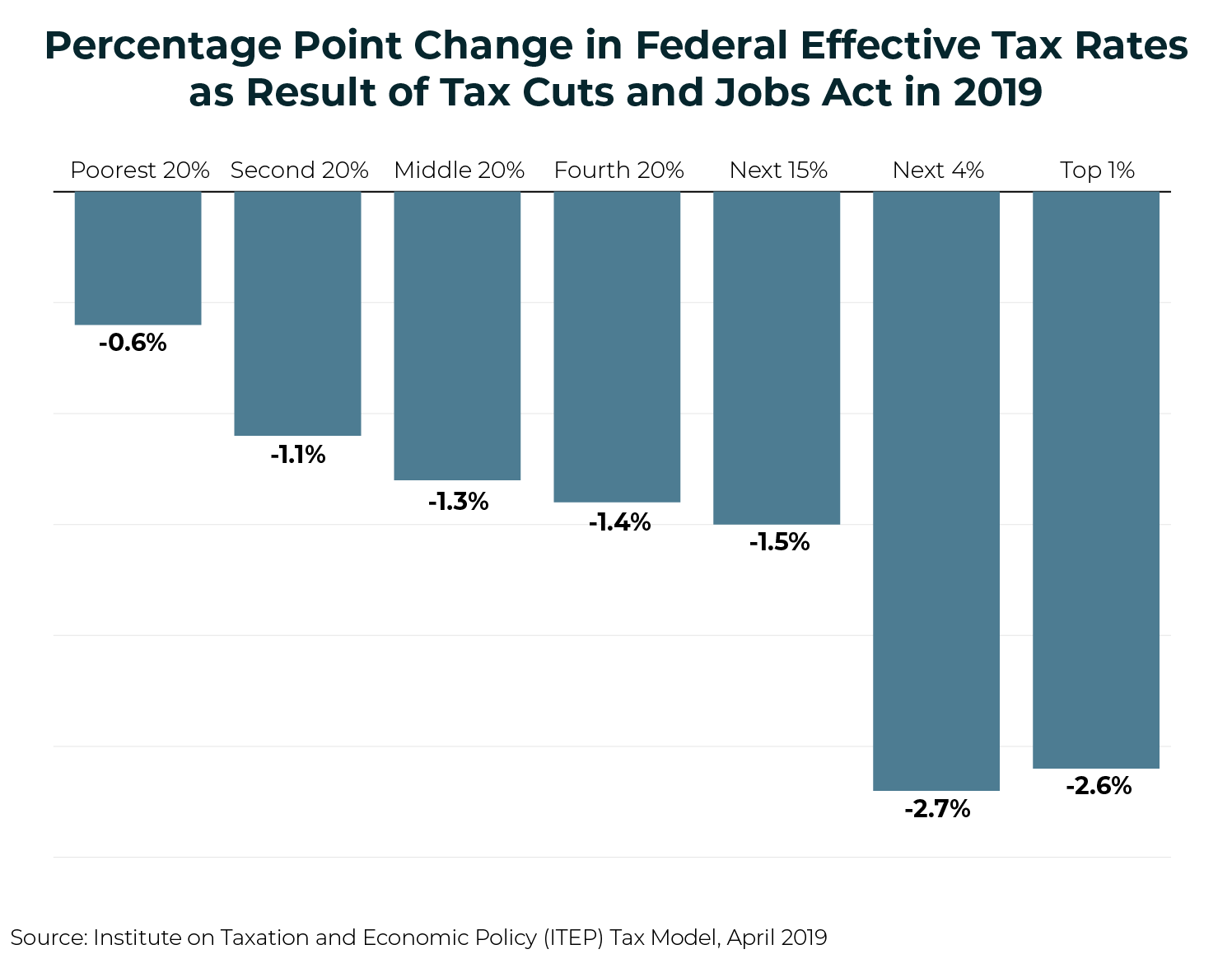

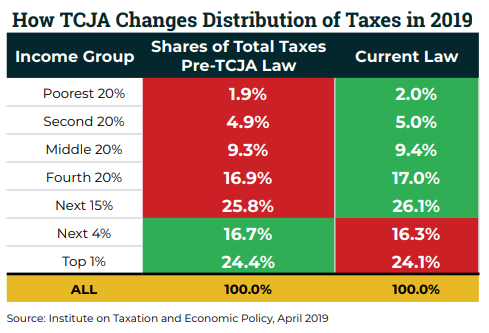

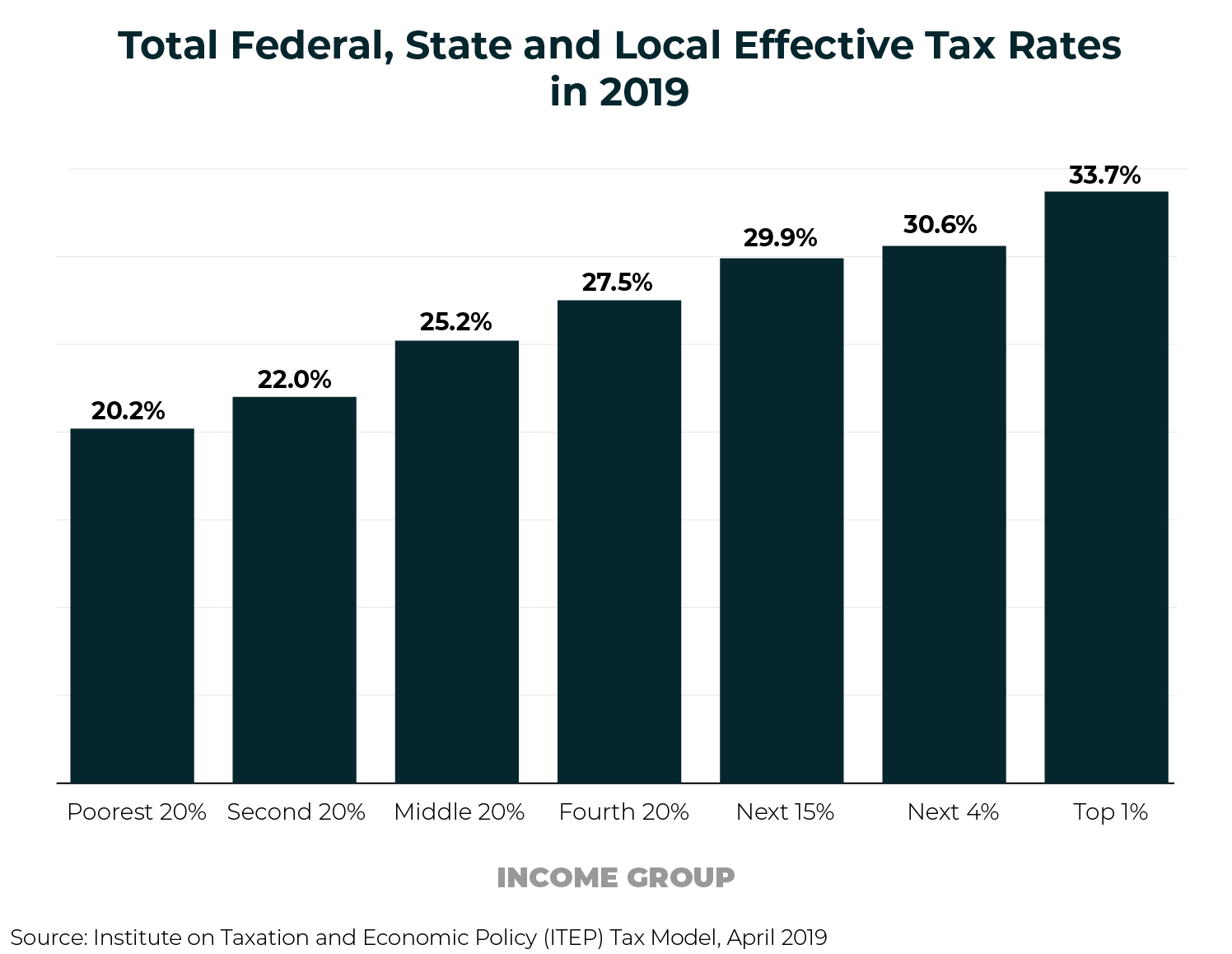

Who Pays Taxes In America In 2019 Itep

Tax Burden By State 2022 State And Local Taxes Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Vermont Estate Tax Everything You Need To Know Smartasset

Idaho Income Tax Calculator Smartasset

Idaho Health Legal And End Of Life Resources Everplans

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Idaho Wills And Trust Requirements

Who Pays Taxes In America In 2019 Itep

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Idaho Health Legal And End Of Life Resources Everplans

How Much Is The Property Tax In Round Rock Texas Quora

Idaho Income Tax Calculator Smartasset

Idaho Income Tax Calculator Smartasset

Tax Burden By State 2022 State And Local Taxes Tax Foundation